Planning for Financial Freedom

Structure your finances for a happier Future!

We assist in developing a financial roadmap to secure your income, investments, and assets to achieve your life goals, aspirations, and future endeavours.

Who Is It For

We offer clear, practical strategies to help individuals build a strong financial foundation and move confidently toward lasting financial freedom in a structured manner. Our financial guidance is tailored for salaried professionals, entrepreneurs, young professionals beginning their careers, families planning for key life events, and anybody who looking to establish financial stability.

Why It Matters

Without a structured financial plan, even high earnings can lead to stress. Whether you want to buy a house, fund your child’s education, or achieve early retirement, financial planning is essential.

How Linac Helps

We simplify the process of aligning your finances with your goals, so that you achieving your dreams. Over the years, Linac has been delivering measurable results and enabling financial freedom through this step-by-step methodology:

1

Identify Goals

We help you identify your financial goals and plan your investments accordingly.

2

Understand Risk & Product Selection

We tailor strategies to align investment choices with your risk-taking ability.

3

Simplified Investing

From KYC to investments to redemptions, we facilitate our clients to have a hassle-free experience through technology and on-field customer support.

4

Education & Guidance

We empower you with knowledge about your investments, the risk involved, and keep you posted regarding the latest market trends.

5

Real-Time Support

With our digital tools, you get instant updates, insights, and control over your investments.

Retirement Planning

Retire at your convenience!

Retirement planning involves saving and investing to secure your future with a steady income once you decide to retire.

Who Should Consider It

- Individuals in their 30s or 40s ideally

- Self-employed professionals without corporate pension plans

- Individuals nearing retirement

Can I afford to retire?

Retirement Calculator for Investment Planning & Savings

Why Retirement Planning Matters

Retirement planning is about more than just securing a fixed income for your post-working years—it’s about financial freedom, stability, and peace of mind in a time when regular earnings may stop, but life doesn’t. From inflation to unexpected medical costs, retirement is full of uncertainties that demand preparedness.

Key reasons to plan early:

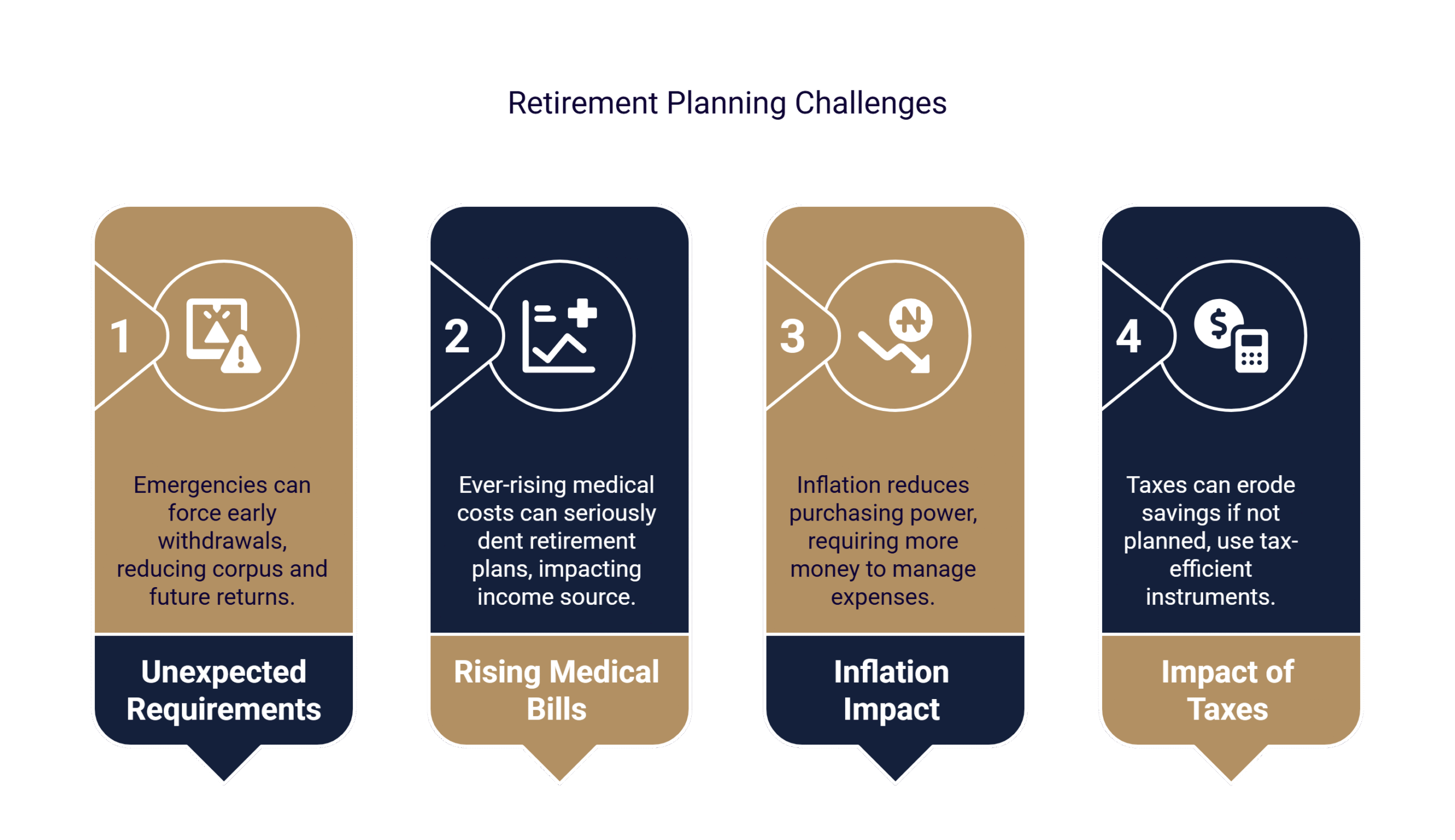

- Unexpected Financial Requirements: Emergencies like health crises or family obligations can lead to premature withdrawals, reducing your retirement corpus and its future potential.

- Rising Medical Expenses: Healthcare inflation can deplete your savings unless pre-planned through health insurance or medical corpus allocation.

- Inflation: A 5–6% annual inflation rate can erode your purchasing power drastically over time. Planning with inflation-adjusted returns is critical.

- Taxation: Without tax-efficient investment instruments, taxes can silently eat into your savings.

How much do I need for retirement?

There’s no one-size-fits-all number. Here’s a step-by-step process:

Step 1: Set the Goal

Imagine your retirement—lifestyle, travel, hobbies, healthcare, etc. This vision defines the financial goal.

Step 2: List Down Expenses

Some expenses reduce (e.g., children’s education), but others like healthcare and housing may rise. Account for all.

Step 3: Plan for Longevity

Plan assuming a long lifespan. Longevity is a financial risk and being underprepared could lead to dependence or hardship.

Step 4: Use Planning Tools

Online retirement calculators and professional advisors can help bring clarity to your retirement needs.

Income Sources in Retirement

Instead of just asking, “Have I saved enough?”, ask, “How many income streams will I have?”

- Pensions (government or private sector)

- Annuities

- Rental Income

- Business or Freelancing

- Part-time Work

- Systematic Withdrawal Plans from Investments

- Dividend Income or Capital Gains from Equity/Mutual Funds

Multiple sources reduce dependency and provide flexibility in managing expenses.

Retirement Planning Challenges

Medical Inflation

Costs are rising faster than general inflation.

Inflation-Adjusted Returns

Your investments must outpace inflation to retain purchasing power.

Taxation

Inefficient tax planning reduces effective returns.

How Linac Supports You

We make your retirement vision a reality by:

Assessing your Retirement Needs

We analyze your retirement age, expenses, and lifestyle goals to calculate your required funds.

Investment Options

We offer tailored suggestions to suit your retirement needs and age.

Tax Planning

We offer tax-efficient investment strategies to maximize post-retirement income.

Withdrawal Strategy

We design SWPs (Systematic Withdrawal Plans) and regular Cash flow investment options for a reliable post-retirement income.

Mistakes to Avoid

Avoiding common mistakes can save you from major pitfalls:

Starting Late

Time is the biggest ally in compounding. Even a 6-month delay can reduce returns substantially.

Skipping Emergency Funds

Unforeseen expenses can derail retirement plans if not accounted for.

Being Too Conservative

Over-reliance on low-return assets may result in an underfunded retirement.

Ignoring Holistic Planning

A narrow view may leave gaps in your financial roadmap.

Final Thought

Retirement planning is a lifelong commitment, not a one-time event. With proper planning, a disciplined approach, and professional guidance, you can secure a comfortable, independent, and fulfilling post-retirement life.

Let LINAC help you design a retirement roadmap that offers not just wealth—but peace, security, and the freedom to live life on your terms.

FAQ

Retirement Planning FAQ’s

Why is retirement planning important?

Because your income may stop, but expenses won’t. A good retirement plan ensures you maintain your lifestyle and stay financially independent.

How much money do I need for retirement?

It depends on your current lifestyle, inflation, and life expectancy. A financial plan helps estimate and bridge that gap.

What is the right age to start planning for retirement?

The earlier, the better — ideally in your 20s or 30s. More time means smaller monthly investments and more compounding.

What is a Systematic Withdrawal Plan (SWP) for retirees?

SWP allows you to withdraw a fixed amount monthly from your mutual fund investment — like a pension from your own savings.

Are investments for retirement planning taxable?

Yes, investments made for retirement planning can be taxable, depending on the product. E.g., mutual funds are taxed based on type (equity or debt) and holding period, while EPF, PPF, and NPS have different tax rules — some are tax-free, some partially taxed at withdrawal. A smart plan balances growth and tax efficiency.

Is retirement planning only about investment?

No, it also includes health cover, estate planning, emergency funds, and budgeting for post-retirement goals.

What is financial freedom after retirement?

It means living your retirement years with dignity, comfort, and choice — without being dependent on others or worrying about money.

Why Linac Finserv?

We believe you deserve more than just investment choices — you deserve a trusted partner in your financial journey. We blend meaningful relationships, expert guidance, and intelligent technology to help you build lasting wealth and a secure future.

Reach out to us today and get closer to your dreams, freedom, and a secure future!

AIFS

Alternative Investment Fund

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text.

PMSs

Prime Minister’s Scholarship Scheme

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text.